PhonePe, BHIM app gains amid RBI curbs on PayTM: The Fintech Market Analysis

The recent regulatory actions by the Reserve Bank of India (RBI) have sparked significant upheaval in India’s digital payments landscape, particularly impacting leading fintech player, Paytm. As Paytm faces scrutiny over persistent non-compliance issues, its market dominance faces challenges while competitors like PhonePe and BHIM app seize the opportunity to gain ground. In this comprehensive analysis, we delve into the implications of RBI curbs on Paytm’s operations, stock market performance, and employee morale. Additionally, we examine Paytm’s response to the regulatory scrutiny, the broader perspective on regulatory oversight in the fintech industry, and the supportive stance of India’s startup community towards Paytm’s founder, Vijay Shekhar Sharma. Join us as we dissect the intricacies of this regulatory saga and explore its ripple effects on India’s digital payments ecosystem.

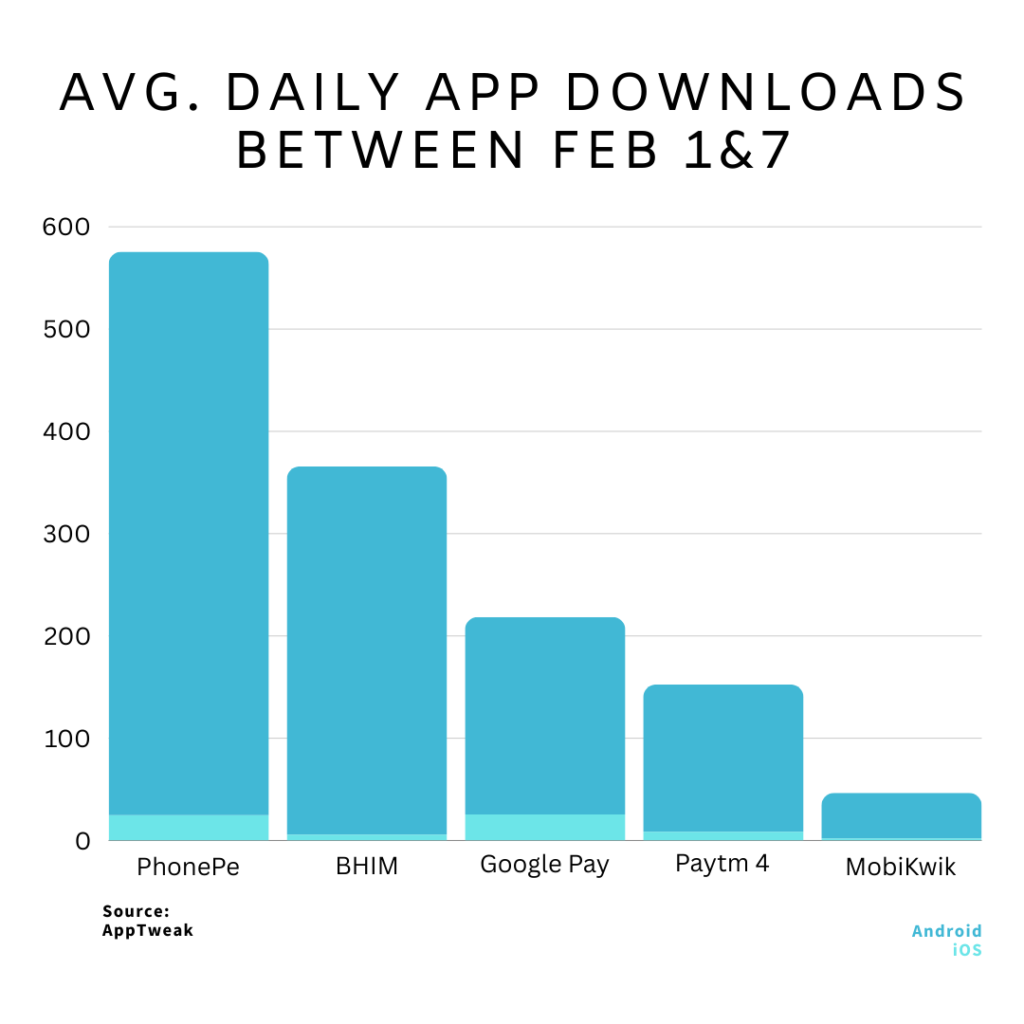

Shift in App Downloads amid RBI curbs on PayTM

Paytm, once a dominant player in the digital payments realm, witnesses a notable decline in app downloads following regulatory scrutiny by the Reserve Bank of India (RBI). Meanwhile, competitors like PhonePe and BHIM app experience a surge in popularity among users. This shift in download trends underscores the impact of regulatory actions on consumer behavior and market dynamics. PhonePe and BHIM app’s increasing downloads signal a growing preference for alternative platforms amid concerns over Paytm’s compliance issues.

RBI's Persistent Non-Compliance Notice

RBI’s decision to impose regulatory restrictions on Paytm stems from persistent non-compliance issues flagged by the central bank. Swaminathan Janakiraman, RBI’s Deputy Governor, emphasizes that the supervisory actions are a result of prolonged engagement with Paytm, during which regulatory deficiencies were highlighted and corrective measures were urged. The central bank’s move underscores the importance of regulatory compliance in the financial sector and its commitment to maintaining stability and integrity in the digital payments ecosystem.

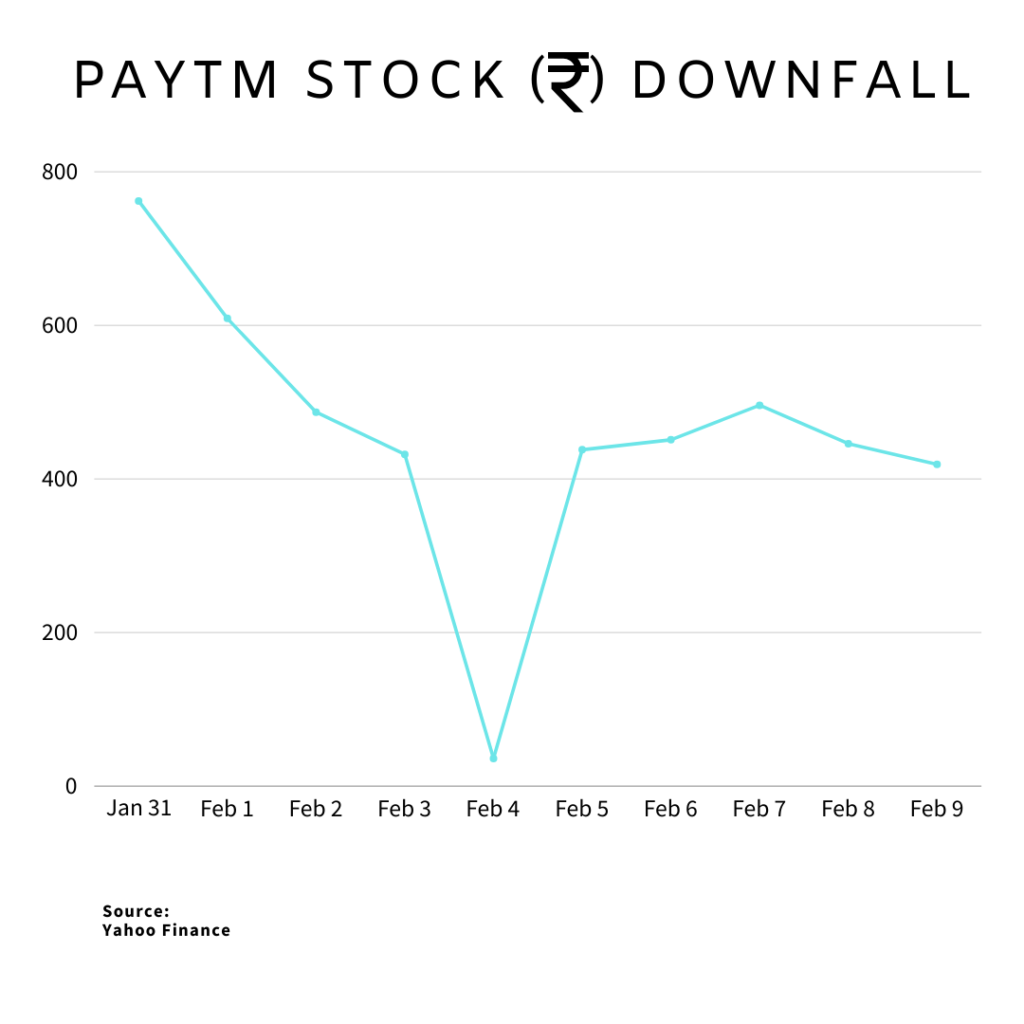

Stock Market Response

The announcement of RBI curbs on Paytm triggers a sharp decline in Paytm’s stock prices, reflecting investor concerns over the company’s regulatory challenges. Paytm’s shares experience a significant downward trend, signaling apprehension among investors regarding the company’s future performance and regulatory compliance. The stock market response highlights the pivotal role of regulatory compliance in shaping investor confidence and market sentiment, underscoring the importance of regulatory transparency and adherence to compliance standards for fintech companies.

#MarketsWithMC | Paytm stock down nearly 9% in trade

— Moneycontrol (@moneycontrolcom) February 8, 2024

"We impose supervisory restrictions when a regulated entity doesn’t take corrective action. All our actions are in the interest of systemic stability", says RBI Governor @DasShaktikanta.#LIVE updates 👇… pic.twitter.com/uAd6PlNIgg

Scope of RBI curbs on PayTM

The regulatory measures imposed by RBI primarily target Paytm’s payments bank and wallet operations, while exempting the Paytm UPI app from the restrictions. This distinction highlights the specific areas of concern identified by the central bank regarding Paytm’s compliance with regulatory requirements. By focusing on the payments bank and wallet segments, RBI aims to address systemic risks and safeguard the interests of consumers and the broader financial ecosystem while allowing certain services like UPI transactions to continue uninterrupted.

Paytm's Response on RBI curbs

In response to RBI’s regulatory actions, Paytm assures users and stakeholders that its app remains fully operational, with services unaffected by the regulatory curbs. The company underscores its commitment to maintaining seamless operations and assures users of continued access to essential services like QR codes, Soundbox, and card machines. Paytm emphasizes its efforts to bolster partnerships with other banks to mitigate any disruptions and ensure the uninterrupted delivery of services to users across the country.

In response to the regulatory challenges and concerns over compliance, Paytm’s parent company, One97 Communications, has announced plans to establish a group advisory committee. Chaired by former SEBI chairman M. Damodaran, the committee aims to bolster the board’s capabilities in navigating regulatory complexities and ensuring adherence to compliance standards. Comprising industry stalwarts such as former president of the Institute of Chartered Accountants of India, M. M. Chitale, and banking veterans like R. Ramachandran, former chairman and managing director of Andhra Bank, the advisory panel brings a wealth of expertise to address regulatory issues effectively.

Employee Uncertainty at PPBL

Amidst regulatory uncertainties surrounding Paytm Payment Bank Ltd (PPBL), reports emerge of employees seeking alternative job opportunities due to concerns over potential job security. This underscores the human impact of regulatory actions on fintech companies and highlights the importance of effective communication and transparency in managing employee concerns during periods of uncertainty.

In addition, post RBI curbs on Paytm, reports indicate the resignation of two independent directors, Shinjini Kumar and Manju Agarwal, from the board of Paytm Payments Bank. Their departure signals potential turbulence within the company’s governance structure and underscores the challenges Paytm faces in navigating regulatory scrutiny. Despite these challenges, Paytm’s establishment of an advisory panel chaired by former SEBI chairman M. Damodaran signifies a proactive approach towards strengthening compliance mechanisms and restoring investor confidence in the face of evolving regulatory landscapes.

Perspective on RBI's Actions

The regulatory actions initiated by RBI against PPBL prompt a re-evaluation of the regulatory landscape and its implications for the broader fintech industry. While the measures underscore the importance of regulatory compliance and oversight in maintaining financial stability, they also raise questions about the effectiveness of existing regulatory frameworks in addressing systemic risks and ensuring consumer protection. The developments highlight the need for continuous dialogue between regulators, industry stakeholders, and policymakers to address emerging challenges and foster a more resilient and inclusive financial ecosystem.

Support from Startup Community

In the wake of regulatory challenges faced by Paytm, there is a notable outpouring of support from India’s startup community towards Vijay Shekhar Sharma, the founder of Paytm. Industry leaders and entrepreneurs rally behind Sharma, expressing solidarity and offering encouragement amidst the regulatory scrutiny faced by Paytm. The show of support underscores the solidarity and camaraderie prevalent within India’s vibrant startup ecosystem, where stakeholders stand united in navigating challenges and driving innovation in the fintech sector.

I'd rather be a Vijay Shekhar Sharma than a Raveendran Byju anyday. Period. pic.twitter.com/aXcWBCR6yy

— Kritarth Mittal | Soshals (@kritarthmittal) February 1, 2024

Amidst stormy challenges, Vijay Shekhar Sharma steers Paytm with unwavering determination. A visionary leader, he navigates turbulence with resilience. In the face of adversity, Sharma's tenacity shines, a beacon for the company's future. Paytm's captain stands strong, charting a… pic.twitter.com/l7SJ2HZaXr

— Prafull Billore (@pbillore141) February 1, 2024

Vijay Shekhar Sharma is a prominent figure in the Indian business landscape and the founder of Paytm, a leading digital payments platform.

— Sumit Kapoor (@moneygurusumit) February 2, 2024

Recently, RBI imposed major business restrictions on #Paytm Payments Bank, which caused the company's stocks to drop by 20%.

Even with… pic.twitter.com/94aPufZyov

Conclusion

As regulatory scrutiny intensifies and market dynamics evolve, the digital payments landscape in India undergoes significant transformations. While regulatory actions against Paytm underscore the importance of compliance and accountability in the fintech sector, they also create opportunities for alternative players like PhonePe and BHIM app to gain traction among users. Moving forward, stakeholders must collaborate to address regulatory challenges, foster innovation, and ensure the continued growth and stability of India’s digital payments ecosystem.

New Updates on RBI curbs on Paytm - 13 Feb 2024

RBI Stands Firm, No Review on PayTM Bank Curbs

Despite mounting pressure, RBI Governor, Mr. Shaktikanta Das, reiterated the central bank’s stance, ruling out any reconsideration of the stringent restrictions imposed on Paytm Payment Bank. The decision underscores RBI’s commitment to upholding regulatory compliance and ensuring the stability of the financial ecosystem. In a bid to address customer concerns and provide clarity amidst the regulatory turmoil, RBI plans to release detailed FAQs outlining the implications of the curbs and offering guidance to affected stakeholders. As Paytm navigates these challenges, the regulatory landscape continues to evolve, shaping the future trajectory of digital payments in India.

Petition Campaign by Startup Founders

While some startup founders have launched a petition campaign protesting the regulatory action against Paytm Payment Bank, RBI Governor Mr. Das emphasized the importance of adhering to regulatory frameworks. Despite arguments that the regulatory measures could stifle innovation in the fintech space, RBI remains steadfast in its commitment to fostering a conducive environment for innovation while ensuring compliance with regulatory norms. This highlights the delicate balance between fostering innovation and maintaining regulatory integrity in the financial sector.

Axis Bank Open to Collaboration with PayTM

Axis Bank’s willingness to collaborate with Paytm across various business lines presents a potential avenue for Paytm to navigate the regulatory challenges it faces. However, any collaboration would be subject to approval from the RBI, underscoring the importance of regulatory compliance in such partnerships. As Paytm explores opportunities to sustain its operations amidst the regulatory constraints imposed on Paytm Payment Bank, collaboration with established banking entities like Axis Bank could offer strategic advantages in navigating the evolving regulatory landscape.

Support Sought by PayTM

Amidst regulatory constraints, Paytm Payment Bank is actively seeking support in critical areas such as backend infrastructure for UPI, Fastag services, transit cards, and wallet operations. These collaborations are essential for ensuring the continuity of services and mitigating the impact of regulatory restrictions on customer experience. Paytm’s efforts to secure partnerships underscore its commitment to adaptability and resilience in the face of regulatory challenges. By leveraging strategic collaborations and seeking support from industry stakeholders, Paytm aims to navigate the regulatory landscape and sustain its operations amidst evolving market dynamics.

Macquarie Downgrades PayTM

Macquarie Equity Research has downgraded #Paytm to "Underperform" and sharply cut its 12-month target price to Rs 275 from Rs 650, saying the bank is "Fighting for survival".

— YourStory (@YourStoryCo) February 13, 2024

by @sayanwho

Read more 👇https://t.co/tKA59zoTyr.

Macquarie Equity Research’s downgrade of One97 Communications (Paytm) reflects growing concerns over the company’s ability to navigate regulatory challenges and sustain its business operations. The significant reduction in revenue projections underscores the impact of regulatory changes and RBI directives on Paytm’s financial performance. With the downgrade to “Underperform” and a sharp reduction in the target price, investors are cautious about Paytm’s prospects amidst regulatory uncertainties. The downgrade highlights the urgent need for Paytm to reassess its strategic priorities, strengthen compliance mechanisms, and rebuild investor confidence to regain market traction amidst the evolving regulatory landscape.

Can PayTM Weather the Storm?

The regulatory restrictions imposed by RBI pose significant challenges to Paytm’s operations, particularly for Paytm Payment Bank. With restrictions barring deposit-taking and credit activities, Paytm faces an uphill battle to maintain its market position and sustain customer trust. The extent of the impact on Paytm’s operations remains uncertain, with experts expressing concerns over the potential exodus of customers and revenue loss. Paytm’s ability to weather the storm will depend on its capacity to adapt to regulatory requirements, innovate its business model, and rebuild customer confidence amidst the evolving regulatory landscape.